If you’ve ever dipped your toes into international shipping, you’ve probably come across a bunch of confusing numbers and acronyms.

Two that almost always trip people up are HS codes and HTS codes. At first glance, they look the same—just strings of digits that customs people seem obsessed with.

But here’s the catch: they’re not the same, and mixing them up can cost you time, money, and even shipments stuck at customs.

So, what’s the difference between an HS code and an HTS code? And why should importers, exporters, and even small business owners care?

In this guide, we’ll break it down in plain English, with real-life examples, so you’ll never second-guess these codes again.

What is an HS Code?

Think of the HS code (short for Harmonized System code) as the universal “language” of global trade.

It’s a 6-digit number that tells customs officials around the world exactly what kind of product you’re shipping—whether it’s a box of coffee beans, a designer handbag, or a brand-new smartphone.

The HS system is maintained by the World Customs Organization (WCO) and is used by over 200 countries.

Pretty much every product you can imagine has an HS code. For example, roasted coffee beans fall under HS code 0901.21.

No matter if you’re shipping from Brazil to Germany or Vietnam to Canada, that HS code will mean the same thing.

In short: the HS code makes sure everyone is on the same page when it comes to product classification in international trade.

What is an HTS Code?

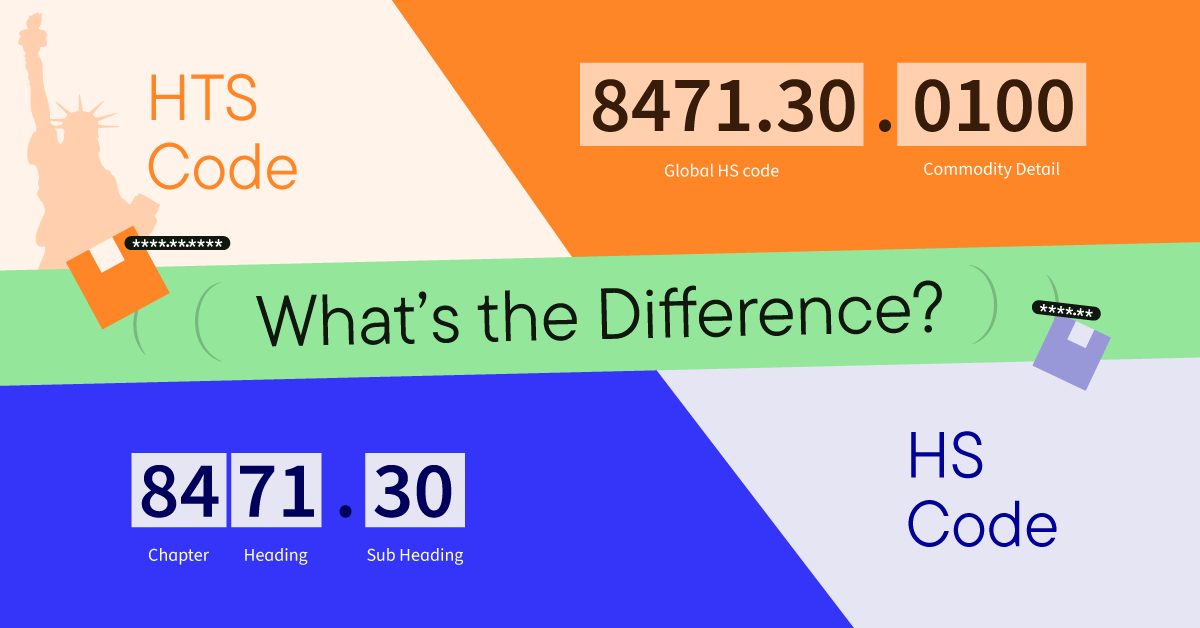

Now that we’ve covered HS codes, let’s zoom in a bit. An HTS code (short for Harmonized Tariff Schedule code) is basically the U.S. version of the HS code—but with a little extra detail.

Here’s how it works:

- It starts with the same first 6 digits as the HS code (so everyone around the world stays on the same page).

- Then, the U.S. adds up to 4 more digits to get super specific.

- These extra digits help the U.S. Customs figure out things like the exact duty rate, taxes, and any regulations tied to your product.

👉 Example:

HS code for roasted coffee beans = 0901.21 (internationally recognized).

HTS code in the U.S. might be 0901.21.0035 (which tells Customs exactly what type of coffee it is, and what duty rate applies).

So, think of the HTS code as the HS code with an American twist—same base, just more detailed so Uncle Sam can calculate how much you owe when your goods land in the U.S.

HTS Code vs HS Code: The Key Differences

At first glance, HS and HTS codes look almost identical. But once you dig in, the differences start to matter, especially if you’re dealing with U.S. imports. Here’s the quick breakdown:

Simple analogy:

If the HS code is like the global product zip code, then the HTS code is like the U.S. version of that zip code with extra house numbers so Customs knows exactly where to send the bill.

Why Does This Matter for Importers & Exporters?

Okay, so you might be wondering: “Do I really need to care about these codes, or is this just customs jargon?” Spoiler alert: you definitely need to care. Here’s why:

- Customs Clearance Without Huddle

- Using the right HS/HTS code makes sure your shipment doesn’t get stuck in customs limbo. The wrong code? That’s a fast track to delays, extra paperwork, or even your goods being sent back.

- Accurate Duties & Taxes

- Those extra HTS digits aren’t just for fun—they determine exactly how much duty or tax you’ll pay.

- Get it wrong, and you might overpay (ouch) or underpay (which could lead to fines later).

- Staying Compliant

- Customs authorities take classification seriously. Misclassifying goods—whether on purpose or by accident—can get you slapped with penalties.

- Think of correct codes as your insurance against unnecessary headaches.

- Better Trade Data

- On a bigger scale, governments use these codes to track trade statistics. For businesses, that means the data is out there to analyze trends, plan smarter, and understand your market.

Bottom line: HS and HTS codes aren’t just bureaucratic numbers. They’re the backbone of smooth global trade, and knowing how to use them can save you time, money, and frustration.

How to Find the Right Code for Your Product

Choosing the right HS or HTS code isn’t just about ticking a box—it’s about keeping your shipments moving, your costs accurate, and your business compliant.

But here’s the kicker: with thousands of codes out there, it’s really easy to slip up.

And if you’re thinking, “Okay, but what’s the worst that can happen if I pick the wrong one?” — don’t worry, I’ve already covered that in detail.

Check out my blog: What Happens If You Choose the Wrong HTS Code?.

Common Mistakes to Avoid

Even seasoned importers and exporters slip up with HS and HTS codes. Here are some of the biggest pitfalls to watch out for (and sidestep):

- Using the Wrong Code

- This one’s a classic. Picking the wrong classification can cause delays, surprise duty bills, or even penalties. Double-check every time.

- Thinking HS and HTS Are the Same

- Close, but not quite. Remember: HS is the global standard, HTS is the U.S. version with extra digits. Mixing them up can mess with your customs paperwork.

- Forgetting Codes Change Over Time

- HS codes are updated every five years. If you’re still using an old list, you might already be out of compliance. Always stay updated

- Copy-Pasting from Other Countries

- Just because a product has a certain HTS code in the U.S. doesn’t mean it’s the same elsewhere. Always check the country-specific version.

Pro tip: When in doubt, ask an experienced international freight forwarder. A quick check with a pro can save you a world of trouble.

Conclusion

At the end of the day, HS codes and HTS codes are more than just numbers—they’re the key to keeping your international shipments moving without delays or surprise costs.

HS codes set the global standard, while HTS codes add that U.S.-specific detail customs need to calculate duties and taxes.

The catch? Choosing the wrong one can create expensive headaches. That’s where we come in.

At Air7Seas, we’ve helped countless businesses navigate the maze of shipping regulations, customs requirements, and product classifications.

Our team knows the ins and outs of HS and HTS codes, so you can focus on growing your business while we handle the compliance details.

Frequently Asked Questions

1. Are HS codes and HTS codes the same?

Not exactly. An HS code is the international 6-digit product classification system, while an HTS code is the U.S. version that extends the HS code with extra digits for duty and tax purposes.

2. Who assigns HS codes?

HS codes are maintained by the World Customs Organization (WCO) and are used by more than 200 countries to standardize trade.

3. How many digits are in an HTS code?

An HTS code usually has 8–10 digits. The first 6 digits come from the HS code, and the extra digits are U.S.-specific.

4. What happens if I use the wrong HTS code?

Using the wrong HTS code can cause customs delays, incorrect duty payments, or even penalties. (For the full breakdown, check out our blog: What Happens If You Choose the Wrong HTS Code?).

5. How do I find the correct HS or HTS code for my product?

You can search official databases like the U.S. International Trade Commission website, check the WCO’s resources, or work with a customs broker. Or, simply let experts like Air7Seas handle it for you—we’ll make sure your shipments are classified correctly.